- Car

- Car Insurance

- Imported Car Insurance

- Non-UK License Holder Insurance

- Previously Cancelled Insurance

- Temporary Car Insurance

- Van

- Van

- Fleet Insurance

- Home & Property

- Home Insurance

- Holiday Home Insurance

- Landlord Insurance

- Park Home Insurance

For most people, a house is the most expensive thing they will own. Check out our handy guide to help protect your assets.

Request a callback Get a quote online

If you need further help, just call 0333 414 1872

Insuring your property correctly is very important. If a house and its contents were to suffer substantial loss, very few owners have the finances to repair or replace without the help of insurance. But for some homeowners, particularly first-time buyers, home insurance can seem like a daunting thing to get correct. What does house insurance cover? Which house insurance policy is the right one to get for your property? Is it necessary to get contents insurance as well? Luckily, help is at hand. Whether you’re a first-time buyer or already on the property ladder, we here at Brightside have compiled this handy home insurance guide to help anyone arrange their home insurance for both their property and possessions. Meaning you can avoid getting multiple Home Insurance quotes unnecessarily.

Unlike Motor Insurance – where under the Road Traffic Act it is a legal requirement to have insurance – homeowners insurance is not compulsory. If you have a mortgage on your property, your lender may make it a requirement to have an insurance policy in place. This is to protect their financial interest in your property.

Your circumstances will largely determine what type of home insurance you need. The basics of home insurance are buildings insurance, contents insurance and a combination of the two. As with most insurance policies, you can also select differing levels of cover based on your individual needs.

Most insurance policies are issued on an indemnity basis. This means you will simply be either reimbursed for the works carried out following a claim or receive the current value of the item. However, household insurance policies differ from this system due to being issued on a new-for-old basis. This means that where you make a claim against any section of your policy you would either get a new equivalent model of the original item or the property would be rebuilt to its original status.

For example, if your property was to be affected by a fire and your TV of 5 years was damaged, you would receive a brand new TV of similar make & model.

In general, insurable interest is at the heart of insurance. It means that in order to insure something you must have a financial connection to it, usually ownership. There are two main types of property ownership: Leasehold and Freehold. It is important to know the differences between them so you can accurately choose which cover you need.

-images/content-6-col--personal-possessions.png?sfvrsn=6a90bec3_2)

Every home insurance policy will usually cover the following standard perils, but we recommend checking with your provider to confirm these specific instances are included in your policy as necessary:

-images/content-6-col--accidental-damage.png?sfvrsn=6290bec3_2)

Accidental damage cover is an addition to a standard policy. This means you would be covered for all the perils mentioned above, plus damage caused by accidents. Accidental damage insurance can be applied to either the buildings, contents or both should you choose to do so – it solely depends on what you would want to be insured for.

An example of accidental damage to the buildings would be if you were to put your foot through the ceiling whilst in the loft. Likewise, an example of accidental damage to contents could be spilling red wine on a white carpet.

It is important to understand that home insurance does not include cover for damage caused by wear and tear. This means that any gradual operating decline, faulty design or faulty materials would not be covered. However, they may be covered under the product's warranty instead.

An example of something caused by wear and tear, which would not be covered by either home insurance or accidental damage cover, is if a dishwasher broke down due to its age.

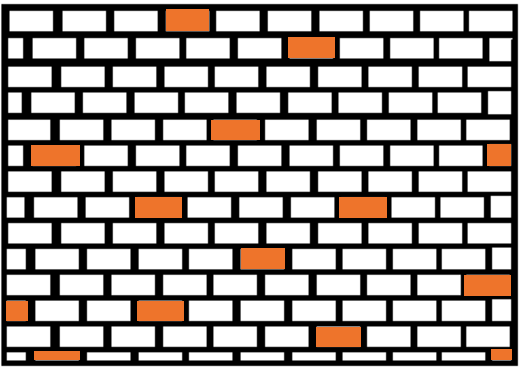

In general, most houses in the UK are comprised of brick or stone walls. Both of which are usually considered as standard construction. Other materials used are:

• Bungaroosh

• Cob

• Corrugated Iron

• Metal

• Pre-fabricated

• Stone

• Wattle & Daub

• Wood

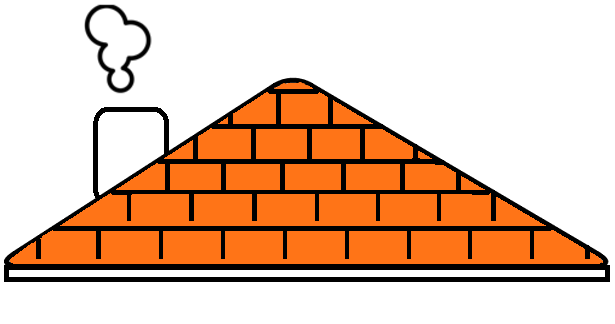

Most property roofs in the UK are constructed of either slate or tiles. Both of which are usually considered as standard construction. Other materials used are:

• Asbestos

• Asphalt

• Concrete

• Felt

• Fibreglass

• Lead

• Shingle

• Thatch

When looking to obtain contents insurance, you must first be aware of what exactly the term ‘contents’ applies to. Your contents will be defined as household goods and personal belongings which you own or are responsible for, such as electrical equipment, furniture and clothes. However, contents can also include:

• Fixtures and fittings other than a Landlord's fixtures and fittings

• Television, satellite and radio receiving aerials, aerial fittings and masts fixed to your home

• Gas and electric cookers and meters

• Valuables

• Office equipment

• Carpets

• Contents of the garden

If you choose to have contents insurance cover, it will automatically set to be covered inside the home. This is unless you specifically ask for cover outside the home for items you might take out and about, for example; electronic devices such as your smartphone, jewellery and bikes.

If you need cover outside the home or have items that never leave the house but are of high value you will need to inform your insurance company. These items can be broken down into two sections; specified and unspecified personal possessions.

Sometimes it is necessary for an insurer to apply a certain clause or endorsement to the insurance which relates specifically to the policyholder's insurance. This can be for a variety of reasons (most common on specialist home insurance) and will usually show on your insurance schedule. Some examples of these are:

-images/content-6-col--key-cover.png?sfvrsn=7524bcc3_2)

Our Key Cover provides you with up to £1,500 of cover for locksmith charges and replacement locks. If your keys were to be lost or stolen, this will also cover the cost for a new set, including any expensive car keys or immobilisers. You can rest assured knowing that the key cover comes with a 24-hour helpline, 365 days of the year, so you won’t be locked out in the rain.

-images/content-6-col--home-emergency.png?sfvrsn=6e90bec3_2)

They say to expect the unexpected and with our 24-hour home emergency assistance, you can do just that. Whatever the weather, we will come out to you for a variety of home related emergencies. It covers for up to £1,000 over the year for failure of your main utilities such as gas, electric and water.

-images/content-6-col--legal-expenses.png?sfvrsn=7124bcc3_2)

We can provide you with Legal Protection to help recover losses should a non-fault accident with an un-insured driver occur. You can take advantage of up to £100,000 worth of legal expenses, covering solicitors and court fees. This also includes Personal Injury and Loss of Earnings cover if unable to work after an accident. In the worst-case scenario, cover is available for fees incurred should prosecution be brought against you in connection with any lawful use of the insured vehicle.

-images/content-6-col--excess-protection-cover.png?sfvrsn=6524bcc3_2)

Unfortunately, claims are sometimes necessary to make and you will usually have to pay out an excess when a claim occurs. However, once the claim has been settled, Excess Protection will refund you the money you have paid out, so you’ll never be out of pocket. You can choose whether you’d rather be covered for up to £150, £300, £500 or £1,000 over the year – the choice is yours. Having this can potentially reduce your insurance price, as you’ll be able to select a higher-level excess to reduce the overall cost.