You’re purchasing a brand-new vehicle and in the back of your mind you may be thinking – do I need GAP insurance? Insurance companies don’t tend to shout about it so it can be hard to know what GAP Insurance is and how it works. Learn about different types of GAP Insurance, what it covers and whether it’s worth it

GAP Insurance Explained

You’ve just purchased a brand-new car from your chosen dealership and made sure it’s exactly how you imagined. You may have heard of GAP Insurance in the past but may not have thought it applied to you. However, you may change your mind when you find out that as soon as you drive your new car it loses 15% of its value. This is where GAP Insurance comes in.

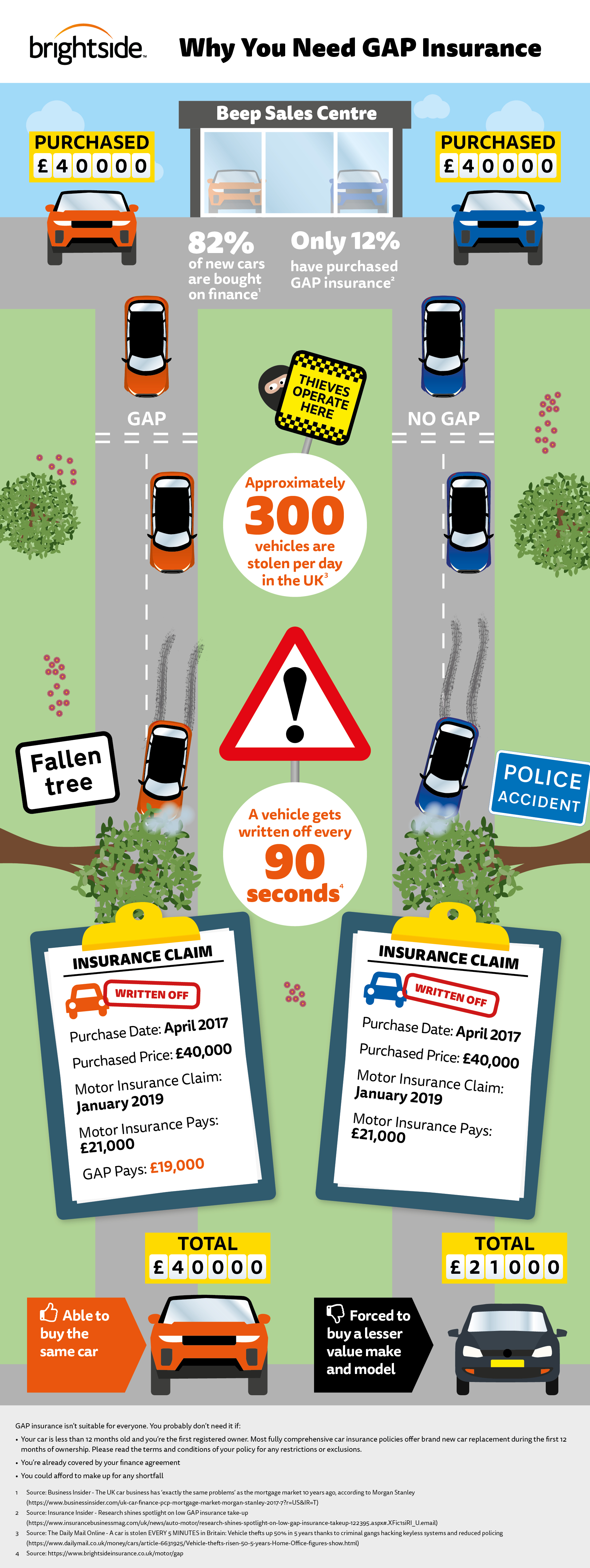

GAP Insurance is financial protection if your car is stolen or written off. Regular insurance in these instances will pay out what the car is worth at the time of the incident, which is usually a lot less than what you originally paid. GAP Insurance will pay the difference between the money acquired by your insurance and what you originally paid for the vehicle. For example, if the original purchase was £10,000 and your insurance pay you £3000, your GAP insurance will cover the remaining £7000.

Is GAP Insurance Worth It?

As discussed, vehicles lose a lot of their value as soon as you leave the forecourt, while a brand-new vehicle can lose most of its worth in the first few years.

Depending on how you’ve financed your vehicle and the level of insurance you currently have, not having GAP Insurance can lead to various problems.

If you have purchased your vehicle on finance and it gets written off or stolen, you may be left paying for a vehicle you don’t own anymore. Additionally, if you purchased your vehicle in full without GAP Insurance, you may be seriously out of pocket. GAP Insurance ensures that you’re protected, and you may be able to purchase your dream car once again.

What Does GAP Insurance Cover?

GAP Insurance is there to aid you where your standard insurance cannot. GAP Insurance covers:

1. Theft: If your car is stolen and unrecovered, GAP Insurance ensures you get back what you originally paid.

2. Damage: If your car is extremely damaged from an accident and has to be written off the road, GAP Insurance will cover the negative equity.

What GAP Insurance Doesn’t Cover

1. Deductible costs: You will still have to pay your agreed upfront costs to your insurance company.

2. Engine failure: GAP Insurance only covers instances of theft or an accident, not mechanical repairs.

3. Bodily injuries or death: Any injuries on yourself or another party are not covered by GAP Insurance; it is only applicable to vehicle losses.

Types of GAP Insurance

You can protect yourself regardless of how you financed your car. There are three common cover types:

1. Return to invoice GAP: This covers the difference between the insurer’s settlement value and the original value of the vehicle. This is obtainable if you have the invoice from a VAT registered dealership that confirms the amount paid at purchase.

2. Finance and Contract Hire GAP: If you’ve bought a car through finance or contract hire and there is a total loss claim, some insurers will pay the finance provider for you. Taking out GAP Insurance here means that you protect yourself against the debt that this situation may create.

3. Agreed value GAP Insurance: This provides the difference between the standard insurer pay-out and an agreed percentage higher than the retail value at the time of taking out the GAP policy. This is great for people who have bought their vehicle privately or through a car dealer.

How much is Gap Insurance and How Long Does it Last?

Depending on the provider or the specific policy, you can usually purchase GAP Insurance for several years until you either claim, or the policy runs out. The length of time can be decided by you, and payments can be paid upfront or monthly.

At the beginning of a policy, your car will be valued, resulting in the cost of the GAP Insurance. When you come to renew your policy, your car will be valued again (providing it’s not over seven years old).

You will only be allowed to apply for GAP Insurance if you’re the named driver of the car, and over 18 years old.

GAP Insurance Tips

- Your dealership will probably attempt to sell you GAP Insurance. Alternatively, there are plenty of independent companies that specialise in GAP Insurance – and you may get a better deal.

- Dealerships can’t sell you GAP Insurance past the fourth day after purchase. If you choose to get covered elsewhere, you can get it at any time; however, your car will decrease in value after you take it home. Because of this, it may be worth shopping around and comparing prices so you can add the GAP Insurance on straight away.

- GAP Insurance doesn’t only apply to new vehicles that are worth a certain amount. Vehicles that are worth as low as £10,000 can be covered by GAP Insurance, as well as cars that are 2-5 years old rather than brand new.

How to Get GAP Insurance

As discussed, there are countless companies that provide GAP Insurance; you don’t have to use your dealer.

Purchasing GAP Insurance is simple, just answer a few basic questions about your vehicle – for example its value and how long you’d like cover for. This time limit can vary based on your preference and can be renewed; however, seven years is the maximum.

If you’re thinking about purchasing a brand-new vehicle or a second-hand car that is relatively new, there are plenty of alternatives that should suit you. Get in touch with us here at Brightside on 0203 167 7827 to discuss relevant options.

Leave a comment